Highly Profitable Trading Strategy Gone Wrong and Goblin On The Run

RIP BOZO AVI

Avraham Eisenberg was involved with a team that operated a highly profitable trading strategy back in October involving the Mango Markets protocol and I even wrote about the situation back in October.

This was my closing thoughts on the situation.

LMAO.

I wonder what happens in this situation. Will the criminal investigations continue? Will this proposal actually in practice? Is code law? Will the DAO stop functioning as a DAO and just go after the guy? Will the hackerman get to keep his $50m and live life as a diplomat of a Caribbean nation or will he get caught by the FBI and sent to prison?

Guess we will find out.

Also I wonder if the $50m USDC has been frozen by circle since the hackerman mentions in his proposal that he would only return the funds if it was pinkie promised that it wouldn't be frozen. I would check the chain but I can barely read the Sol blockchain explorers so I will leave that to the Caroline's gang to find out.

Wonder how much Sam lost during the hack. Surely they lost a bunch. Who else had money in a Solana lending protocol??

Turns out code was not law and the DAO stopped functioning as a DAO and just went after the guy. The hackerman Avi got to keep his $50m for a while but then got arrested in Puerto Rico and charged with market manipulation offenses.

The saddest thing about the situation is that his tweets were bangers and he was CT main character for quite a while using his newfound fame from his Mango Markets trading strategy to flex his wealth on chain during peak bear market and even tried to make Aave get into negative debt but ended up getting liquidated on like $20m of positions.

He also bought a bunch of FTX accounts OTC for 10c on the dollar when withdrawals were halted because he wanted to profit from the bankruptcy being played out over the years.

He claims he bought around $10m of accounts so $100m in FTX account dollars. Well at least he ended up bailing out a bunch of people for 10c on the dollar amirite.

Well during the court proceedings we are going to see of “Code is Law” is actually going to hold up and unfortunately I don’t have my hopes up for DeFi to win this one.

Avi was charged with 1 count of commodities fraud (guess they don’t want to debate whether crypto is a security and just get it over and done with for the market manipulation part) and 1 count of commodities manipulation. Some random guy on Twitter said that this means he can get a max jail sentence of 35 years so there’s that.

Not the biggest fan of Avi for flexing too much on us poors obnoxiously but he will be a great guinea pig in testing how “code is law” works against the US legal system and how regulators define laws in DeFi.

Not a fan of government regulated DeFi (lmao) but it is what it is. Hopefully the wild west continues at least in pockets of new ‘innovation’ that regulators will take a while to catch up to.

Also one hilarious thing is looking through Avi’s tweets right before his arrest. Literally the last tweet he LIKED before getting arrested was this. Poetic.

Bankman-Freed

The goblin can’t keep getting away with it. It’s crazy to me that he got Released on $250 Million Bond (using his parents $4m property as collateral) AND known Alameda wallets and SBF wallets came to life days after his release.

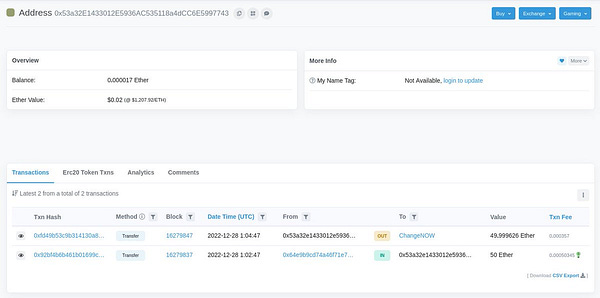

https://etherscan.io/address/0xd57581d9e42e9032e6f60422fa619b4a4574ba79

The Alameda wallets then funnelled the money into FixedFloat and ChangeNow which are uhhhhhhhhhhhh sus exchanges which are used to conceal of the origins of illegally obtained money. Also FTX Liquidators won’t be using these types of exchanges to liquidate customer assets so this is someone who is not apart of the liquidation crew.

Surely the goblin should not be allowed to access the internet while on bail. CAN BANKRUPTCY LAWYERS DO SOMETHING. SURELY THEY KNOW THAT HE HAS ACCESS TO MORE STOLEN CUSTOMER ASSETS WITH ACCESS TO THE INTERNET. DO SOMETHING!!

Here’s a list of funny Avi tweets: