President on brink of bailout for crypto

what was i made for

The President of the United States has just issued an Executive Order announcing the creation of a Crypto Strategic Reserve which consists of cryptocurrencies such as Bitcoin, Ethereum, Solana, Ripple and Cardano. This means that the U.S. Government will be buying and holding these coins to ‘elevate this critical industry after years of corrupt attacks by the Biden Administration’.

This decision in and of itself has not been a complete surprise considering the Trump administration has been hinting at a possible Bitcoin Strategic Reserve for the past few months since he first acknowledged the industry slightly less than a year ago. The real shock to the industry comes from the fact that this reserve will also consist of other coins which are a lot less reputable and significant and are not even held by most ardent supporters of the industry being relegated to the sidelines in the recent bubble making the only viable reason they are added to this reserve being corruption. To understand how we got to this situation, here’s a brief overview of Trump and his relationship with this industry which he is so proud to be a champion of.

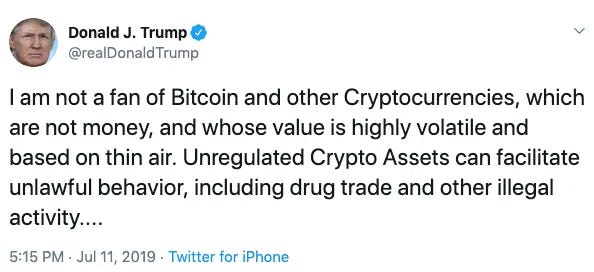

Prior to his 2024 Presidential Campaign, Donald Trump barely talked about Bitcoin let alone crypto and his only reference to it that the crypto community kept talking about during his first term was this tweet.

Then came the Biden administration in Jan 2021. For beginners, the crypto industry (if you can even call it that) dates back to 2008 when the creator of Bitcoin, Satoshi Nakamoto published the whitepaper for Bitcoin which was supposed to be a decentralised peer-to-peer electronic cash system. Since then it has surpassed the wildest dreams of early adopters and become mainstream in recent years. Bitcoin and the subsequent coins that followed form what is now collectively known as the crypto industry.

Crypto is a very cyclical industry with the most glorious boom and bust cycles every four or so years. For example, the price of a Bitcoin peaked at around $20,000 in late 2017 and went as low as $3,000 in March of 2020 before skyrocketing to $69,000 in November 2021. While the price increased, regulators around the world including the U.S. Government started to focus on it more as despite the claims of financial innovations going on through blockchain technology, it was mostly unprecedented amounts of frauds and scams that were guised behind the nascent internet technology, the most famous of these being SBF, FTX and Terra-Luna.

At this point, the Biden administration decided to tackle the issue through what is colloquially called Operation Chokepoint 2.0 which was beautifully explained by Nic Carter back in early 2023 in Pirate Wires, although if you want a more bland one liner commentary by me you can read it here instead.

Anyways, the original Operation Chokepoint was a series of DOJ initiatives by the Obama administration to pressure banks into cutting off access to financial services to a list of businesses that were deemed to be “unsafe” thereby effectively choking them out without any explicit regulation. The list of industries and companies affected by these are wide reaching but some examples are payday lenders, firearms and ammunition sellers, online gambling, debt collection, pawnshops, tobacco sellers, early cryptocurrency firms and more. It was a pretty clever way of enforcing policy preferences without any actual legislation.

As can be seen by the Carter post in early 2023, the idea of the Biden administration running back the same playbook was common knowledge around that time to Silicon Valley and crypto industry observers. Operation Chokepoint 2.0 consisted of the Biden administration putting regulatory pressures on banks to warn them about the risks associated with dealing with crypto firms which made it harder for them to maintain banking relationships. While this seems like a reasonable operation at first glance, Silicon Valley argues that the Biden administration was using this to dictate what industry should or should not be allowed in America without democratic process or clear laws.

Moreover, Silicon Valley asserts that the Biden administration not only targeted the banking relationships of crypto firms but slowly expanded to tech founders who had nothing to do with crypto. Furthermore, some people like billionaire a16z venture capitalist Marc Andreessen claim that the Biden administration even targeted political opponents by essentially sanctioning them and cutting them out of the existing financial system.

Andreessen claims that this is one of the reasons why a significant faction of Silicon Valley’s most influential elites switched to supporting Trump (which is further supported by Elon though he had his own issues with the Biden administration and their regulators as it pertained to SpaceX and Tesla). Silicon Valley claims that this was done through controlling power over agencies such as FDIC, OCC and the FED. Moreover, enforcement actions from the SEC and CFTC alongside restrictive FED policies made compliance costly and pulled down the industry. The most clear example of these attacks can be seen through crypto-friendly banks like Silvergate, Signature and Silicon Valley bank being pressured by the government or crumbling and collapsing leading to on and off ramps to the U.S. financial system being cut.

All of this to say, Silicon Valley and more specifically the crypto industry which was growing in wealth and influence through its booms and busts was not pleased with the way the Biden administration was stifling innovation in the industry through what they felt was unnecessary and predatory regulation.

Thus, from 2022 to 2023, the industry not only had to face trillions in market valuation drawdowns during the bear market but also with the massive abhorrent amount of fraud and scams their house of cards was built with by bad actors such as SBF. To make matters worse, the Biden administration sent Washington D.C. regulators after the industry.

Then came Trump.

This might be forgotten in the annals of history and be mistaken purely for gambling cryptocurrency bros betting on the convicted crazy guy as felon (which it mostly is) but Trump had higher odds in crypto prediction markets like Polymarket and FTX ( before its collapse when it had TRUMP2024 tokens). This was because of influential trader philosophers of that bubble era making predictions that Trump will return and this disparity existed until the election was called for Trump.

Anyways, during his third presidential campaign in 2024, Trump set out to win his second non-consecutive term as President which was a feat only mustered once before by Grover Cleveland in the late 19th Century. He was however under constant lawsuits and attacks by the DOJ and was even convicted of felonies and had his mugshot taken in a picture that will go down in history alongside his assassination attempt photograph to capture one of the most chaotic and wildest American presidential campaigns in history. Anyways, at this point Trump decided that he must win at all costs and began appealing to groups that the Biden administration had ignored or gone against and crypto was one of them.

He initially appealed to Bitcoin by accepting it for donations for his campaign in May 2024 and said he wants to build a “crypto army” leading up to the elections. Then two weeks after his attempted assassination attempt, Trump attended the Bitcoin 2024 conference in Nashville, Tennessee where he made stronger promises to the crypto community in exchange for their vote. Major promises included firing the staunchly anti-crypto SEC Chairman Gary Gensler, creating a Crypto Advisory Council, commuting the sentence of Bitcoin martyr Ross Ulbricht and creating a Bitcoin Strategic Reserve.

The crypto industry which needed a pivot away from the Biden administration, threw their weight at Trump. Elon’s support immediately after the attempted assassination had already changed some minds in Silicon Valley (or rather allowed people to express their support for Trump (or rather their distaste of the Biden admin regulations and attacks on the tech industry)) and that coupled with Trump’s pro-crypto stance made it clear that even if Trump’s promises weren’t guaranteed, it was a whole lot better than supporting the continuation of Operation Chokepoint 2.0 (which Trump himself would acknowledge as the “disastrous” policies set by Biden against the crypto people).

Then he won. But despite what most people had come to expect of Trump’s promises, he actually kept them. He made David Sacks of PayPal, Yammer, CraftVentures and All-In Podcast glory the “Crypto and AI Czar” to make him the chief policy advisor for crypto and AI policy in the White House and to act as a bridge between the White House and Silicon Valley. It didn’t hurt that Sacks was a close friend of Musk and knew him from their days working to build PayPal during the dot com bubble and was a key influence in getting Musk to change his political views. Not only that but Trump also fired SEC Chairman Gary Gensler (replacing him with a pro-crypto official), dropped SEC lawsuits against prominent crypto firms such as Coinbase and halted several enforcement actions against crypto firms.

Moreover, Trump also freed Ross Ulbricht who was sentenced to two lifetimes with no parole for creating the SilkRoad dark web website which was like Amazon but for illegal goods and services but paid using Bitcoin in the early few years. The only way he could get out was through a presidential pardon. It was the pivotal site that introduced many early adopters to Bitcoin and what it can be used for (deadskull emoji) and when these early adopters became rich, they kept trying to fund foundations and movements to get Ross freed under Obama, Trump1 and Biden but finally succeeded under Trump2 together with the support of the Libertarian Party.

Moreover, mere days before the inauguration, during the first “Crypto Ball” in Washington D.C. to mark the start of a “New Golden Age” in crypto, Trump released his $TRUMP meme coin. The coin started at a $200 million dollar valuation and 80%+ was owned by Trump insiders. It soon skyrocketed to almost $80 billion dollars before decreasing by well over 80% just a few weeks after his inauguration. Then Melania released her own meme coin and it too had a sharp increase and decrease in valuation. This was reminiscent of Trump using his brand to cash in on NFTs and other projects during the mania of the 2021 bubble but on a much grander scale, since this time he was President-elect again.

Then on the 2nd of March 2025, came this new Executive Order by Trump announcing the New Strategic Crypto Reserve.

This is problematic for dozens of reasons, least of which is the inclusion of coins other than Bitcoin, like Ethereum, Solana, Cardano and Ripple. The broader industry calls Bitcoin-only believers “Bitcoin Maximalists” and while I don’t fully relate to that term, I do believe that the rest of the coins are fundamentally unserious as they diverge from the central tenet that is Bitcoin as envisioned by the creator Nakamoto in the mythical Bitcoin whitepaper. In the wake of the Global Financial Crisis, Nakamoto proposed the Bitcoin network as an alternative to the current financial system and one of its core building blocks was the idea of a decentralised ledger. This ledger was not bound by any man but instead controlled by a system of computers expending energy forever enshrined to the task of computing and solving math problems for a reward.

The core value of decentralisation was short lived in most ensuing blockchains as researchers discovered the now famous blockchain trilemma which is a concept that says that a blockchain can only fully achieve two out of three key properties at once: decentralisation, security and scalability.

For example, Bitcoin was decentralised and secure but couldn’t scale as transaction speeds were slow and became more expensive as Bitcoin price increased. On the other hand, newer blockchains such as Solana boost scalability and security but compromise on decentralisation due to having more centralised control.

Thus, a variety of new blockchains and coins emerged in the fifteen years since Nakamoto released his whitepaper redefining what “crypto” or “digital asset” means altogether.

However, what we are witnessing now due to the EO and Trump proclaiming himself the “First Crypto President” is a fundamental contradiction to the very principles and ideals that gave birth to Bitcoin. Bitcoin was created as a response to government bailouts and centralised financial control—now that same government is bailing out the industry saying that the past administration had attacked it through the DOJ which is incredibly ironic. Moreover, the same government is positioning itself as a major holder and market influencer, effectively becoming the very entity that Bitcoin was designed to circumvent for a more free digital money.

Moreover, while Czar Sacks might rightfully claim that he sold all his crypto and public/private stock market investments, the damage has been done. While a Bitcoin Strategic Reserve was already a hard sell, the inclusion of other coins, and especially these other coins, are telling that the new White House crypto policy is fundamentally unserious and acting recklessly.

By picking these coins, not only is Trump going against the entire ethos of the blockchain and making an ironic joke out of the Bitcoin promise, he is supporting what looks like a badly guised attempt at gross wanton corruption at the highest levels of his government through this Strategic Crypto Reserve.

While the Biden administration might have tried to knock crypto off the map while it was already suffering under the crash and uncovering of deep systemic fraud and scams in the systems, the Trump administration seems to attempt to nuke the industry out of existence with its ludicrous levels of apparent daylight robbery by invoking crypto’s name.

While there is no proof yet of any wrong doing, there are a lot of signs that something might be amiss and the most apparent of these signs is coming from the First Family in the form of Eric Trump. Eric has been no stranger to receiving bad press from his financial dealings during his father’s presidency and this time he is using crypto. He created a crypto project together with his brother Donald Trump Jr. to ‘democratize crypto’ and has been engaged in a tweeting frenzy since December about Bitcoin and Ethereum and other coins. There are rumours and sources that claim that it is not just Eric but other people associated with the Trump Administration that have been profiting legally off of crypto through insider information about the TRUMP, MELANIA memecoins and the coins that were announced as part of this Strategic Crypto Reserve.

However, even if these reports are true, it is very unlikely that anyone will be held accountable due to the Trump administrations control over the DOJ, SEC and other enforcement agencies especially as it pertains to crypto. Moreover, there will most likely be no consequences due to the power of a Presidential pardon which can nullify any wrongdoing that a person engages in before the pardon is signed. Thus, the only people paying for this will be the ignorant fool who buys the word of the administration as it pertains to their crypto policy and buys into whatever schemes they come up with next.

Another group that will need to reflect is the early adopters and true believers in the core tenets of crypto. They will have to grapple with the fact that despite the fact that they might be getting obscenely rich (or poor) , their revolution is being televised, monetised, institutionalised and controlled by the very powers it sought to disrupt.

Of course, we can’t talk about the U.S. government buying Bitcoin without mentioning what this potentially means for the U.S. dollar which serves as the world’s primary reserve currency giving the U.S. dominance in trade and financial power. The point of a Bitcoin Strategic Reserve as commonly espoused by Bitcoin Maximalists was that it was to act as a hedge or even to accelerate the decline of fiat currency such as the dollar. However, due to the way Trump has talked about this reserve and the other coins that are included in this reserve, this seems less likely to be the real reason and more can probably be attributed to Trump paying back the crypto lobby.

Moreover, what’s truly baffling is that for all their grandiose fantasies about a “New Crypto World Order”, no serious person worth listening to in traditional crypto circles ever seriously contemplated the idea of the U.S. government actually embracing cryptocurrency. This scenario was dismissed as delusional in the near future and impossible within most people’s frameworks of the government as an eternal enemy. Yet the path turned out to be embarrassingly straightforward— targeted lobbying, appealing to special interests, winning the hearts (but mostly wallets) of Washington power brokers. The crypto revolution won not through technological superiority or mass adoption which failed miserably in the 2021 bubble but through the same old Washington playbook of influence peddling and political opportunism.

There are also more pragmatic questions to be answered like who is the biggest fool if not the U.S. Government? There is simply no other entity who is a larger buyer who can buy these assets now. Crypto has undoubtedly won. But at what cost. The story of cryptocurrency has reached a pivotal moment where the movement must decide whether they want to attach themselves to Trump and let their precious ideology be at the mercy of a singular man or break free and suffer the consequences of a increasingly partisan cause in the freest land man has created.

We're gonna win so much, you may even get tired of winning. And you'll say, 'Please, please. It's too much winning. We can't take it anymore. Mr. President, it's too much!'