The Markets are Moving

Jan 2023 Review

January 2023 has been an pretty good month for the markets and that’s a pretty big understatement.

The S&P 500 is up 9.30% from $3824 to $4180

The NasDaq is up 17.46% from $10386 to $12200

Apple is up 20.59% from $125 to $151

Ethereum is up 37.45% from $1200 to $1649

Bitcoin is up 41.76% from $16,600 to $23,600

Tesla is up 74.16% from $108 to $188.27

Coinbase is up 142.44% from $33 to $82

You get the idea.

As you can probably guess, all the other coins and tech stocks went up as well and often more than the big indices.

One nice thing about this rally in crypto is that it is led by Bitcoin. Typically when Ethereum leads the rally, it is short lived and froth starts to build up as Bitcoin lags behind and people start longing Ethereum for more returns.

A Bitcoin led rally has historically been a sign of more prolonged growth as well as the market is less frothy and isn’t fully levered long.

That doesn’t mean everyone isn’t [redacted] long right now but its better than ETH led rally.

Also it’s probably a good time to start thinking about what happens if markets corrects in the short term. The S&P has been going up in a straight line for weeks.

ETH-BTC

Now let’s zoom out a bit to see Ethereum’s price when compared against Bitcoin.

This is the 1 Year ETH/BTC Binance chart.

You can’t even see the current 40% ETH rally in this chart and it declines as much as -12.36%.

Now let’s zoom out more.

ETH/BTC peaked back in 2017 and didn’t manage to break that during the latest bull run in 2021.

Also people like GCR are calling this the Echo Bubble similar to how Bitcoin and Ethereum increased in price in 2019.

In 2019, while BTC and ETH increased, ETHBTC decreased by more than 50%.

Just because it’s an echo bubble doesn’t mean ETHBTC will increase.

Of course we have to factor in increased actual usage of the ETH blockchain and increased demand from NFTs, DeFi and new trending protocols.

Also The Merge actually happened in 2022 and ETH is now uLtRa sOuNd mOnEy so its supply is deflationary (#ponzinomicsgoals).

As of now 1.65 Million Ether that would have been minted in PoW hasn’t been minted. Oh and it’s been 141 days so it’s just getting started. We are so early.

So that’s a decrease in miners sell pressure of around $2.7 billion dollars. ETH just avoided one 3ac.

(Google) Trends

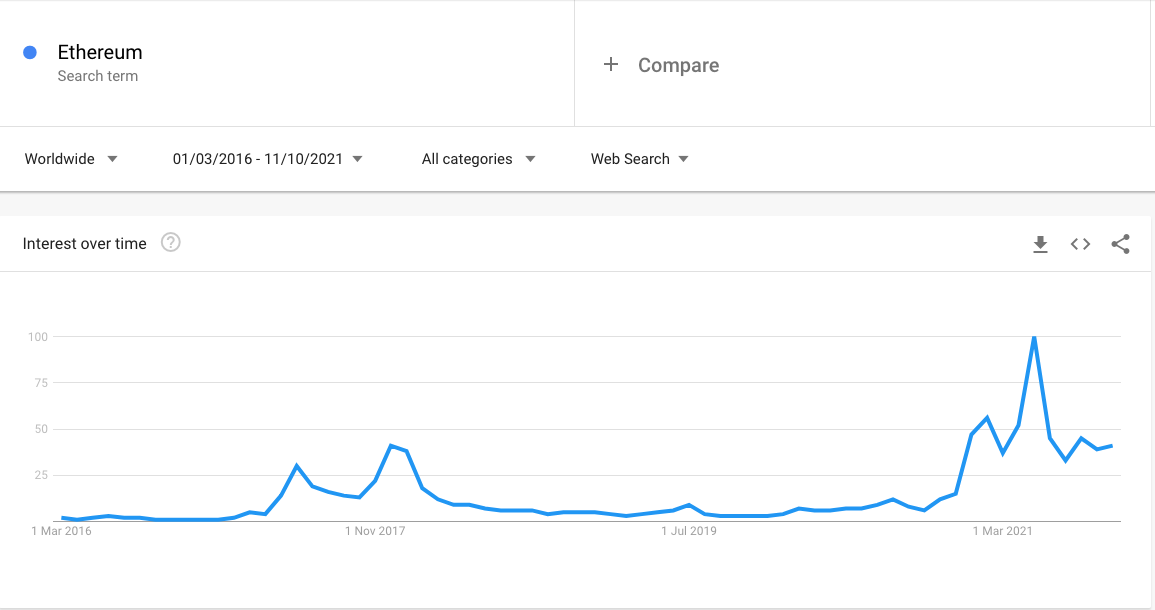

Back in late 2020, I knew very little about what crypto was but my main thesis for buying ETH was looking at Google Trends data for crypto.

This is what I saw at the last week of 2020 and my thesis was that BTC went to new highs, surely the second highest market cap crypto goes up to new highs too. That ended up being right.

‼️ Spoiler alert: This is what happened next ‼️

Now that we have explored what happened the last time ETH was ignited and went on a massive bull run using Google Trends.

Let’s go back the present.

Ethereum and Bitcoin interest hasn’t really increased and activity isn’t even close to what it was months ago even during the ETH Merge led middle of 2022 rally that was the breathe of fresh air in between Celsius/Luna/3ac/Voyager unravelling and the whole FTX fraud.

tldr: jan 2023 gud month. be careful ETHBTC. google trends. online casinos :O