The Winklevoss Twins Are Back

Crypto contagion continues, Tesla crashes, OpenAI, Sam Altman's Worldcoin

The World of Contagion

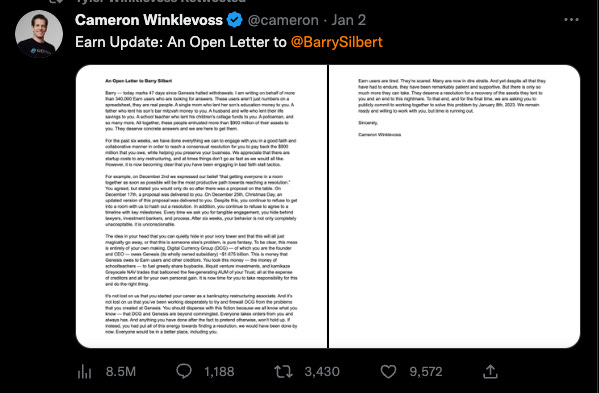

Crypto Contagion mess continues. Gemini Earn (one component of Gemini the crypto exchange) halted withdrawals 49 days ago and CEO Cameron Winklevoss published this open letter to Barry Silbert on Twitter.

Here’s the TLDR of the whole situation:

Gemini launches Gemini Earn which gives Gemini users yield on their crypto

Gemini Earn gave those coins to Genesis (owned by DCG, the same group that created GBTC and ETHE)

Genesis loses the money by giving it out to our boys over at 3AC and lost some money in FTX getting rugged by SBF

3AC lost the money by degenerately longing the supercycle thesis and going all in on shitcoins like Luna/Avax

So now Gemini Earn is $900m in the hole and is unable to payback customers because the money is gone.

In this letter, Cameron talks about DCG and Barry Silbert not cooperating and asks them to work together to help the hundreds of thousands of Gemini users who lost money due to their hubris.

In my opinion, the fault here is with the Gemini company and users (to a much smaller degree). Gemini should have emphasised counterpart risk and emphasised how risky it is to lend out your crypto. The fact that it was lent out to Genesis Trading was mentioned on the website but in a tiny corner of the page designed to attract retail to deposit crypto. The Gemini branding which was almost pristine in a world of clownery has been hurt because of this decision to provide yield earning products and promoting it.

Also if you were really paying attention during the FTX collapse, you could have avoided this mess. Anon threadooors on CT were warning everyone to be aware of Gemini Earn because Genesis Trading announced promptly that they had been hit by FTX pretty badly and people saw Genesis trading mentioned on Gemini Earn website and started writing doomer threads which ended up coming true.

People are asking for the Twins to payback Earn customers by selling their own assets or selling part of Gemini but I think people are overestimating how much money a second or even third rated crypto exchange owner has and how much an exchange is valued at during these bear market conditions in crypto and lack of liquidity in traditional markets due to rising interest rates and macro concerns.

The World of TSLA

Tesla stock continues to tumble after delivery numbers were announced. Production numbers came above expectations but delivery numbers were lower than expected and Tesla crashed another almost 20% and is hovering above $100 per stock.

The World of OpenAI

OpenAI is all the rage nowadays and it was co-founded by Sam Altman (current OpenAI CEO), Elon Musk and others who committed a total of $1B in late 2015. Elon resigned from the board in 2018 to focus on his other companies. Later in 2018, OpenAI received a $1B investment from Microsoft and Matthew Browns Companies.

OpenAI is already valued at $20B in private markets and it probably grows to hundreds of billions of dollars in valuation in the coming years. One interesting thing about OpenAI is that they have a structure that limits of the profits of originally investors like Elon Musk and Sam Altman. Apparently their investment is capped at 100 fold whatever they put in. Let’s say Altman invested $5 million. His originally $5 million would be capped at $500 million. They say this is to ensure that the future of AI is not controlled completely by a small number of people.

The World of Worldcoin

Also not sure how I feel about Altman. He is also the founder of Worldcoin, a project that aims to scan the iris of poor people in developing countries and give them like $10 worth of Worldcoin tokens so that they can get their own individual address in the Worldcoin blockchain. Hmmm.